Deep tech startups across Europe have been attracting significant venture capital funding in recent years. Deep tech refers to companies built on scientific discoveries or meaningful engineering innovations that have the potential to solve real-world problems. According to PitchBook data, European deep tech startups raised $18.4 billion in venture capital funding in 2021, up from just $5.3 billion in 2016. This growth has been driven by government initiatives, university research commercialization programs, and an increase in tech-focused venture capital funds.

Some of the European countries leading the way in deep tech funding include:

United Kingdom

The UK has established itself as a hub for deep tech, with London’s startup ecosystem benefiting from its proximity to top universities like Oxford and Cambridge. Deep tech startups in the UK raised $7.2 billion in VC funding in 2021, accounting for 39% of the European total. Areas attracting major funding include AI, robotics, cleantech and quantum computing. High profile UK deep tech startups include Graphcore, BenevolentAI and Oxbotica.

France

Paris has emerged as a deep tech hotspot, with startups leveraging France’s strong engineering talent and government research. French deep tech startups raised $2.1 billion in VC funding in 2021. Leading areas are data analytics, space tech, medtech and quantum computing. Major funded startups include biotech Dynacure, space startup Kinéis and AI chipmaker Anthropic.

Germany

Germany has a long history of deep tech innovation and startups are now commercializing R&D from institutions like Fraunhofer and Max Planck. German deep tech funding reached $1.8 billion in 2021, with Berlin becoming a key startup hub. Key areas include industrial IoT, energy tech, biotech and quantum computing. Leading German deep tech startups include Volocopter, Celonis and Lilium.

Switzerland

Switzerland boasts world-class technical universities like ETH Zurich and EPFL Lausanne. Deep tech is thriving around these hubs, with Swiss startups raising $0.9 billion in 2021. Major funded areas include robotics, drones, healthtech and greentech. High-growth Swiss startups include energy storage firm Energy Vault and augmented reality headset maker Scrona.

Luxembourg

Luxembourg has worked to position itself as a European hub for deep tech startups, leveraging its proximity to major R&D centers. Deep tech funding reached $0.2 billion in 2021, with startups focused on space tech, autonomy, biomedicine and material science. Key players include orbital launch startup Isar Aerospace and space mining startup Kleos Space.

The following table summarizes total deep tech venture funding across Europe in 2021 for these key countries:

| Country | 2021 Deep Tech VC Funding |

|---|---|

| United Kingdom | $7.2 billion |

| France | $2.1 billion |

| Germany | $1.8 billion |

| Switzerland | $0.9 billion |

| Luxembourg | $0.2 billion |

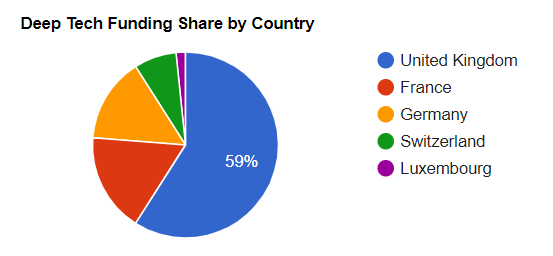

The following chart shows the relative share of European deep tech funding by country:

As the chart illustrates, the UK accounted for approximately 39% of all deep tech funding in Europe. France, Germany, Switzerland follow behind, while Luxembourg remains a much smaller player for now.

Key Factors Driving Deep Tech Growth

There are several factors powering the growth of deep tech startups and investments across Europe:

- Government funding programs like Horizon Europe which provide grants for research commercialization and startup creation.

- Europe’s strong technical universities with deep expertise in sciences and engineering. This provides talent and research that serves as the foundation for deep tech.

- Accelerating pace of tech breakthroughs in areas like AI, robotics, batteries and genetics. This provides opportunities for startups to leverage new discoveries.

- Increased corporate venture capital funding from major European companies looking to fund cutting-edge innovations.

- Large European VC funds like Atomico and Lakestar raising billion dollar funds aimed at deep tech startups.

- Favorable regulations in some countries like France that encourage R&D spending.

Availability of engineering and tech talent that can build complex deep tech products.

The European Innovation Council has revealed that its shortlist for European deep tech scale ups, the ScalingUp TOP50, accrued €527 million in new funding over the past 12 months.https://t.co/cnWOsWHg9U@EUeic @EICScalingUp pic.twitter.com/Kl5sNWgNdo

— Tech.eu (@tech_eu) November 15, 2022

Key Challenges Facing Deep Tech

While the growth trajectory for European deep tech is positive, some challenges remain:

– Deep tech startups often require longer timeframes and more capital to productize research compared to software apps and platforms. Investors must have patience and long-term outlook.

– Finding sufficient specialized technical talent can be difficult for some niche areas like quantum computing or biotechnology. Retaining this talent is also a concern when scaling startups.

– Regulatory hurdles can slow development for highly complex sectors like autonomous vehicles, aerospace and medicine. Navigating each country’s specific regulations is challenging.

– There is still a funding gap compared to deep tech development in countries like China and the United States. Europe needs bigger, later stage VC funds to back startups as they mature.

– Geographic fragmentation makes it hard to achieve pan-European scale compared to more unified markets like the US.

Overall the environment for European deep tech is more robust than ever. With strong fundamentals now in place, Europe is positioned to be a global leader in turning scientific advances into transformative and profitable technologies. However, sustaining this progress will require a concerted effort across private and public sectors to tackle ongoing challenges.